What Technology lessons can ag lenders learn from the home mortgage industry

Although the home mortgage market and farmland mortgage market are very different, there are many things that ag lenders can learn from the home mortgage industry. One area in particular is how quickly technology has transformed the home mortgage market in a short period. This article will look at key trends from home mortgage lenders and explore the potential implications to ag lenders. Specifically, the article address the following topics:

- What technology and lessons are transferable from home mortgages to ag lending?

- How do traditional ag lenders transition quickly and leverage technology to grow?

- What is unique to ag lending and how might technology offer solutions to speed up

certain processes?

Key Trends in Home Lending

In the last 5 years the home mortgage industry has experienced tremendous change and today the vast majority of loans are originated digitally, or depend heavily on a consumer led digital process. Lenders that were well-positioned benefited, lenders that did not invest in a digital experience experienced accelerated decline.

One of the best examples of how quickly this change occurred is Bank of America’s experience. Bank of America was fairly aggressive in pushing a digital application strategy and it paid off in enormous growth in this channel. In 2019, 36% of Bank of America’s home mortgages were digitally originated, by 2021 that number grew to 81%.

Much of this growth was likely accelerated by COVID restrictions, but what is clear is that a properly executed digital strategy can drive growth, as well as increase customer satisfaction. Not only did Bank of America achieve significant growth over this time period, it also received an award from Bankrate for being the “Best Mortgage Lender Overall.”

While Bank of America thrived, other traditional banks that were not able to make investments in technology lost significant market share to purely digital originators. In just five years, fintech companies grew their market share of mortgages by 33%. Online lenders’ market share went from 5% to 38%, at the cost of market share to other traditional finance options, local banks, and credit unions.

The Impact of Digital on On Cycle Time

Offering better digital products has other benefits for both lenders and consumers. According

to data from Freddie Mac, the transition to digital has reduced closing times by ~15%, which benefits both consumers and lenders. In the second quarter of 2020 top lenders processed loans 63% faster than their competitors, or ~15 days faster than the industry average.

The study specifically cites the adoption of digital processes and automations by the top performing banks

as the driving factor behind their ability to close faster:

Effective optimization and use of automated offerings can be a significant solution to help

process loans faster… top performing companies typically integrate digital tools and offerings

into their operations. Lenders that build their manufacturing processes around automated offerings process mortgages five to 15 days faster.”

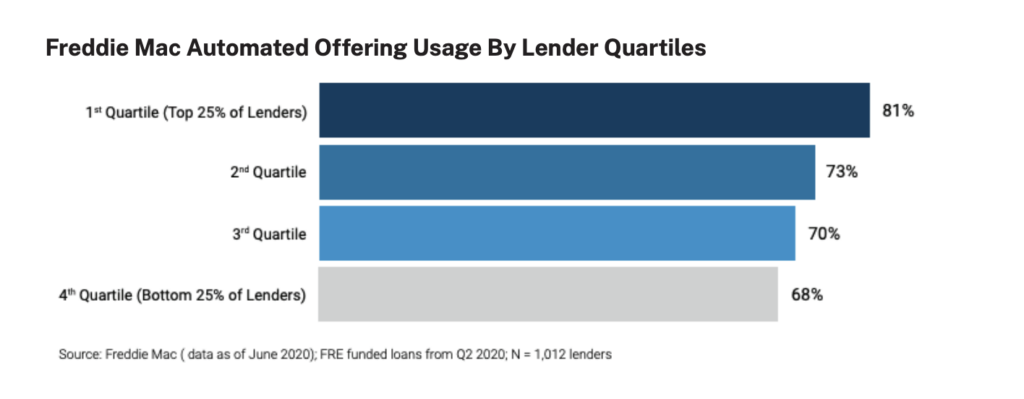

Freddie Mac invested in technology to help their bank customers process loans more quickly, specifically a tool called Assets and Income Modeler (AIM) and a tool called Automated Collateral Management (ACE). Freddie Mac claims that 81% of all loans by top performers used the digital tools furnished by Freddie Mac, as outlined in the chart below:

The study goes on to further link top performers to the adoption of technology and makes key

observations about how successful institutions think about their technology roadmap noting that

the differentiating characteristics of top performers were:

- A clear technology roadmap

- Ability to factor in scalability

- Ability to experiment by rolling out small pilots

- Assess before choosing

Overall the study notes that both large and small lenders can achieve similar results, but the common denominator is an effective technology strategy that takes advantage of digital processes to speed up cycle times. Faster cycle times led to higher origination and more satisfied customers.

What is the right amount of technology for Ag lenders?

Agricultural lending is a different market than the home mortgage market and a significant portion of business in ag is conducted at the kitchen table. Relationships still matter. The difference in adoption of technology in rural America, where most Ag Lenders do the vast majority of their business, is behind the rest of the country. This point is made clear by a 2019 FDIC Survey report that looks at how consumers interface with banks and use technology in banking. The survey found that rural residents were much more likely to visit a branch in person then their urban and suburban counterparts with 41.6% of rural residents visiting a branch 10 or more times a year, vs. 22.6% of urban residents and 26.2% of suburban residents and this is despite the fact that most rural residents have to drive much further to visit a bank branch (source).

However, although it is clear that clients of Ag lenders may be slower to adopt technology than their urban and suburban counterparts, this should not be an excuse to limit investments in technology. In some regards a digital process that reduces trips to the local branch delivers even greater benefit to rural customers where a trip to the local branch could be measured in hours vs. minutes. The savings in fuel and time for rural customers are significant when compared with their urban and suburban counterparts. The results of the FDIC survey may also be somewhat self fulfilling, in that the digital tools available to rural customers may be less available thus requiring them to visit a branch office more often to complete certain tasks. In addition, the survey was conducted pre-pandemic, since the impacts of the pandemic on behavior in rural areas is yet unknown.

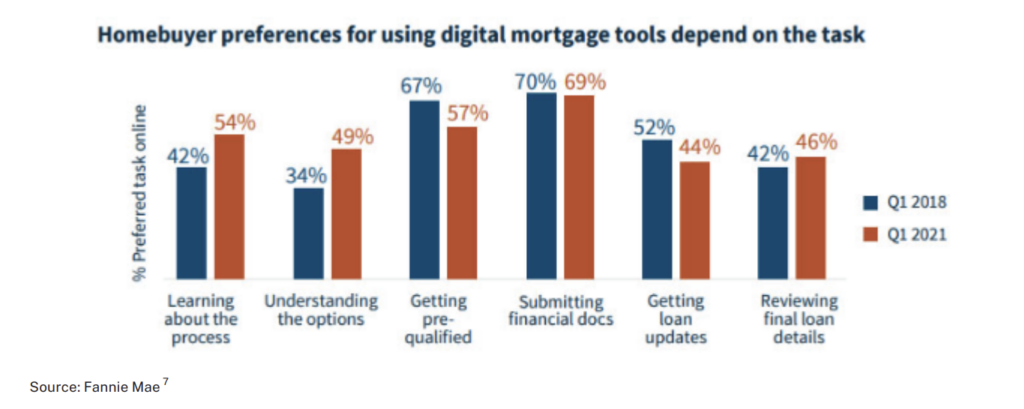

In terms of getting technology right, results from a Fannie Mae study indicate that the right solution for many people is a combination of technology and people. Technology acts as an enabler, allowing clients to complete many tasks by themselves without waiting on a loan officer. Technology can also help complete internal approvals such as valuation of collateral more quickly, speeding up the process. However, most people still value the ability to reach a person when they get stuck, or need advice and expertise. Overall, the Fannie Mae survey indicates that like many things, a one size fits all solution is not the best approach, the results indicate that consumers value a digital process where they have the ability to complete the

entire process independently, but they equally value the ability to contact an expert quickly if needed.

One key result of the Fannie Mae survey, which was conducted to understand how mortgage applications changed during the pandemic, was that although complete digital applications (with no human) contact doubled to 12% those purely digital applications still made up a minority of total applications. The results of the Fannie Mae study would indicate that although a digital experience is crucial to top performing mortgage lenders, there is a limit on what can be accomplished with a digital only solution. For the foreseeable future loan officers, with local knowledge and relationships will remain a crucial part of the mortgage origination process.

What challenges and opportunities exist for Ag Lenders in implementing a digital

strategy?

Although a lot can be learned from the home mortgage space, Agricultural lending is very different. For one, the market encompasses a lot more than mortgages and includes operating loans, equipment loans, building loans and more. The requirements, process and tools to value collateral are also significantly different from the residential real estate market both in terms of sophistication and availability.

However, despite their differences there are also significant similarities. Primarily, the application process for an agricultural loan, whether it is an operating loan, mortgage loan, equipment loan, or other is similar to a home mortgage application. Similar information is required and the process has many parallels. The application process itself is also one of the easiest and fastest components to convert to digital. Unlike Ag lending, PDF applications in the home mortgage market are almost non-existent, yet they are still commonplace in agriculture.

Benefits of a Digital Application for Ag Lenders and Ag Businesses

In the rapidly evolving landscape of agricultural lending, digital loan applications are becoming increasingly pivotal in streamlining and optimizing the lending process that reduces loan processing time. This section highlights the numerous benefits offered by these applications to both ag lenders and ag businesses, presenting a compelling case for their adoption.

Reduces friction for customers: Digital applications make it easier for a customer to start a loan application, signaling their interest in doing business.

Quick information entry: The applicants can quickly input important data, which loan officers can access before any direct communication takes place.

Integration with internal systems: When properly configured, digital applications can be integrated with a bank’s internal systems for credit checks and eligibility reviews. This automation reduces data entry errors and improves efficiency.

Session flexibility: Digital applications allow clients to fill out their applications in multiple sessions, relieving the stress of gathering all necessary documents and information in one go.

Collaboration and assistance: These applications provide a platform for collaboration between a loan officer and the client. Loan officers can step in and assist the client as needed.

Digital signing and submission: Once the application is completed, the client can sign and submit it digitally, further simplifying the process.

Evolution towards automation: As a lender’s internal systems become more advanced, the application process can become completely automated, reducing the need for human intervention.

Human support integration: Even in fully automated systems, human support can be integrated to ensure customers always have access to a person if needed.

With these advantages in mind, a completely hosted digital loan application was the first solution that CamoAg offered to ag lender clients. Today that system gathers all applicant information, performs identity verification, integrates with an automated decisioning system, and keeps both loan officers and client’s up to date via automated notifications. The solution offers flexibility for ag lenders to grow into a completely automated solution as their technology infrastructure is able to support it, but to immediately reap the benefits of a digital application — after all a digital application satisfies the top two preferred tasks to be complete online:

- getting pre-qualified

- submitting financial docs

If you are looking at your digital strategy revamping your loan application experience is the first place to start and dollar for dollar is

likely the most effective investment to reduce cycle times. To learn more about our digital loan application solution specifically for agricultural loans contact us at: https://camo.ag/contact-camoag/

Collateral and Asset Valuation

Another crucial difference between the home mortgage market and Agricultural Loans is the tools available to lenders to quickly value collateral and the value of the land that is to be purchased. It is also an important component to understand the overall financial situation of a farmer when considering an operating loan, as often, a farmer’s farmland is the largest component of their collateral. Unlike the home mortgage industry, the tools to evaluate the value of a home are not as widely available in agriculture and vary widely by region. And although home appraisers are backlogged and often a bottleneck, the problem is even more acute when it comes to finding rural appraisers with an expertise in appraising land and rural properties. The tools available to an appraiser to value farmland are also more limited than their counterparts that specialize in residential homes. However, one parallel between both home mortgage and ag lending is that the valuation/appraisal of collateral and assets is a bottleneck in the loan process and provides a significant opportunity for improvement.

Freddie Mac identified this bottleneck and invested significantly in tool Automated Collateral Evaluation to help their bank partners solve this problem and reduce cycle times. Improving this process is not as visible as implementing a digital loan application experience, however, it represents a significant opportunity to reduce cycle times, which has proven to be a key element in overall customer satisfaction and ultimately market share.

To help ag lenders reduce the time it takes to value collateral and assets CamoAg has created a suite of tools that enable an ag lender to speed up the process, whether they work with outside appraisers, or have an internal appraisal group. The CamoAg tool set enables the quick identification of properties to create a queue for appraisers. The CamoAg solution is designed to work with industry leading appraisal software to reduce the time it takes to identify and verify comps, as well as complete industry standard analysis of both subject properties and comparable properties. Additionally the CamoAg system helps financial institutions keep track of collateral and perform portfolio analytics at scale to evaluate risk as it relates to climate, land class, commodity make up, regional concentration, and more.

For more information on CamoAg’s tools for Ag Lenders and how we can help you develop your

digital strategy, contact us here.

Citations and Sources:

- https://www.forbes.com/sites/brendarichardson/2021/05/13/how-digital-technology-changed-the-face-of-themortgage-industry/?sh=71f5639d2856

- https://www.icemortgagetechnology.com/about/press-releases/homebuyers-expect-digital-mortgages-but-also-want-human-touchcommunication-2018-ellie-mae-borrower-insights-survey-finds

- https://www.besmartee.com/grav/digital-mortgage-10-stats-2021

- https://sf.freddiemac.com/content/_assets/resources/pdf/fact-sheet/mortgage-cycle-time-benchmark-study.pdf

- https://www.fanniemae.com/research-and-insights/perspectives/pandemics-impact-mortgage-digitization-and-homebuyer-satisfaction

- https://newsroom.bankofamerica.com/content/newsroom/press-releases/2022/02/record-81–of-bank-of-america-mortgageapplications-initiated-th.html

- https://www.fdic.gov/analysis/household-survey/2019execsum.pdf Collateral and Asset