Loan Applications

Quicker, Easier Applications and Decision-making

Revolutionize Your Borrowing Experience with Instant Loan Processing

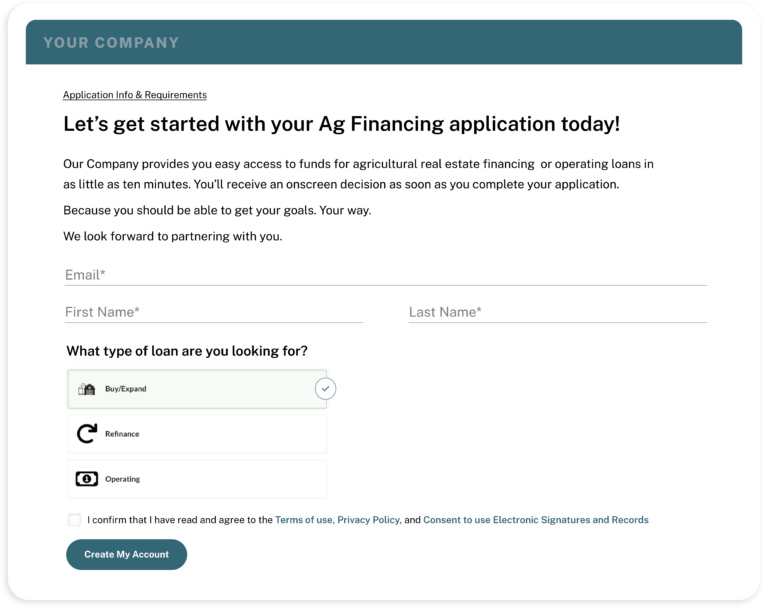

The next time a farmer wants to apply for a loan, there will be no more lost time driving to a bank branch miles away from his properties. No more PDF forms that a loan officer has to manually enter and wrestle with.

A quick, easy, accessible application will let the farmer apply at the touch of a button for financing to purchase more land or buy new equipment. The customer gets better support, while the system makes it easier for the loan officer to do his job.

Let’s say a farmer starts an application and abandons it when he gets busy with his day. A notification will ping a loan officer who can look into the farmer and determine whether he’s a good prospect using the client intelligence tool. If he is, the loan officer can follow up with the farmer individually to provide any support he needs and to help him complete the application.

KEY FEATURES

Real-Time Notifications

Notifications for completed or partial applications.

Automated Credit Reports

Credit reports are automatically created for customers who apply.

Automated Decisioning

Automatic approval or rejected applications based on your specific criteria.

Identity Verification

Confirm your customer's identity automatically.

Scoring

Automated scoring for applicants based on custom criteria.

Integrated with Salesforce

Add and sync contact loan application data directly with your CRM.

Take your loan application process online

Make the lending process more convenient for your customers by offering a hassle-free loan application experience directly on your website.

Book a Demo

See how CamoAg’s technology can take you into the next generation of digital agriculture