Are Investors Increasingly Buying Farmland? A Data-Driven Look at Ownership Shifts

The narrative around farmland ownership is changing, with a common belief that investors, particularly those from overseas, are increasingly purchasing more US farmland from local farmers.

This question has gained prominence against a backdrop of rising global food demand, technological advancements in agriculture, and growing interest in sustainable and alternative investments. This curiosity stems from concerns about food security, the consolidation of farmland ownership, and the implications for rural communities and the environment. With reports of increased activity by institutional investors and foreign entities in the agricultural sector, there’s a pressing need to understand the dynamics of farmland investment and its impact on the agricultural landscape.

We’ve turned to our agriculture intelligence platform to answer this question and understand the trends truly.

Analyzing Distance to Uncover Farmland Investment Trends

By analyzing the average distance between buyers and the land or farms they purchase, particularly focusing on the Midwest, we aimed to discern whether farmland ownership is shifting towards absentee or investor ownership versus local or farmer ownership. Our analysis involved using a 35-mile threshold from a parcel to distinguish between local and non-local buyers. We weighted the measure by acres transacted rather than the number of transactions, recognizing certain limitations in our approach.

This chart visually represents the trend of buyer distance from their farm investments, highlighting stability over recent years.

Above is a chart illustrating the volume of farmland transactions from 2020 to the end of 2023 made by buyers residing more than 35 miles away. Initially, the increase in such transactions over the four-year period may appear concerning. However, upon closer examination, this rise can largely be attributed to the overall surge in farmland purchases overall during this period. As illustrated below despite this increase, the proportion of buyers living more than 35 miles away remained relatively stable throughout this period.

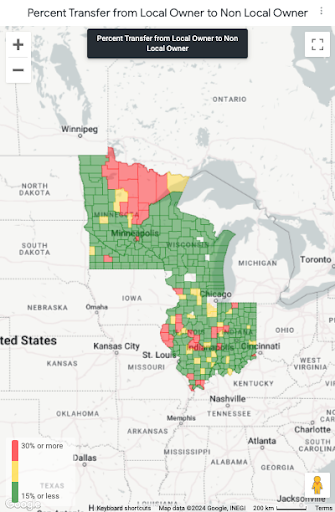

An alternate perspective is provided by a county-wide breakdown, delineating the percentage of farmland being acquired by “local” buyers. Green shading denotes counties where the majority of buyers are local, while red indicates counties where non-local buyers predominate. Notably, certain regions, such as northern Minnesota, witness remote transactions primarily due to the prevalence of timber-rich lands, while others, characterized by recreational properties, may falsely portray a flight of farmland into non-local hands. Nevertheless, the data suggests that the vast majority of farmland is being bought by local actors.

Absolute Transfer of Farmland

An earlier chart underscored that while local buyers account for approximately 70-80% of buyers by acre in the Midwest, this doesn’t imply a corresponding 20-30% transfer to non-local buyers. The reality is nuanced, as a significant portion of farmland is sold by non-local sellers, including investors divesting previously acquired farmland or individuals selling inherited land. Adjusted figures for Illinois, Indiana, Minnesota, and Wisconsin over the four-year period reveal that while a smaller portion of farmland is transferring from local to non-local control, a notable amount is indeed being sold from local sellers to non-local buyers.

(note: this analysis is limited to four states due to the unavailability of seller location for previous states)

The same data viewed at the county level.

Conclusions

An analysis of transactions in the Midwest over the past four years indicates that while the majority of farmland is purchased by local actors, a significant portion is also acquired by non-local entities. However, there’s no discernible acceleration in the acquisition of farmland by non-local actors during this period. The impact of investors on the market remains subject to debate, but it’s evident that farmland continues to be an attractive asset for those seeking low-risk investments and a hedge against inflation, however, should current trends hold control over the vast majority of farmland in the United States will remain in local hands. Furthermore, when farmland is acquired by investors, it’s essential to recognize that most investors, whether large or small, typically do not assume direct operational control of the land but instead rent it to local farmers, meaning that even though the land may not be locally owned, it is still locally controlled.

Take the Next Step & Get 500 Free Leads

Learn how these reports can improve your sales, lead generation and marketing strategies. Contact us for a personalized consultation and kickstart your campaign with 500 free leads!

I Want Free Leads