Why CamoAg’s Automated Valuation Model (AVM) Is a Game-Changer for Farmland Valuation

#FarmCredit #Farmland Values #LandValues

Farmland valuation has historically been a complex and time-intensive process, fraught with regional data inconsistencies and manual workflows. In an industry where speed and accuracy can make or break opportunities, CamoAg’s Automated Valuation Model (AVM) represents a groundbreaking advancement. By merging cutting-edge machine learning technology with unparalleled data integration, we’re setting a new standard for agricultural lenders and appraisers. With CamoAg, the future of farmland valuation is here—and it’s faster, smarter, and more accessible than ever.

1. Turning Proprietary Data into a Strategic Asset

CamoAg’s AVM stands apart because it can be trained on a customer’s proprietary data. This approach transforms existing information into a strategic resource, delivering several unique advantages:

- Maximizing Data Value: Associations can unlock the full potential of their proprietary data, creating models that generate insights customized to their specific needs and regions.

- Data Privacy and Exclusivity: The outputs of models trained with proprietary datasets remain private and accessible only to the customer, ensuring that the competitive advantages stay within the organization.

This approach is especially powerful in regions where data is scarce or complex to analyze. By leveraging proprietary datasets, associations can create a valuation model that performs effectively even in areas traditionally considered unsuitable for AVMs due to limited or inaccessible public data. Imagine a Midwest lender harnessing internal transaction records to build an AVM that rivals evaluations in accuracy and far out performs in terms of speed.

2. Enabling AVMs Without the Overhead

Historically, deploying advanced tools like AVMs required robust IT infrastructure and technical expertise, making them inaccessible for many associations. CamoAg eliminates these barriers by providing the machine learning expertise and the technology infrastructure. The association only needs to contribute its data.

This accessibility ensures that even associations with limited IT resources can deploy and benefit from an AVM, unlocking new efficiencies without requiring a dedicated technology team. By reducing the overhead associated with advanced modeling, CamoAg democratizes AVM technology, making it viable for small and mid-sized organizations.

3. Learning from the Home Mortgage Industry

The home mortgage industry has demonstrated the transformative potential of AVMs. By incorporating digital processes and automated valuation tools, leading lenders have significantly reduced cycle times. According to Freddie Mac, top-performing mortgage lenders reduced loan processing times by 15% — or approximately 15 days faster than their competitors — thanks to the adoption of digital tools and automation.

CamoAg’s AVM brings similar efficiencies to agricultural lending. By automating key valuation processes, it enables lenders to:

- Reduce the time it takes to validate and approve loans for properties with straightforward characteristics.

- Shorten cycle times for transactions involving strong credit profiles and consistent land use.

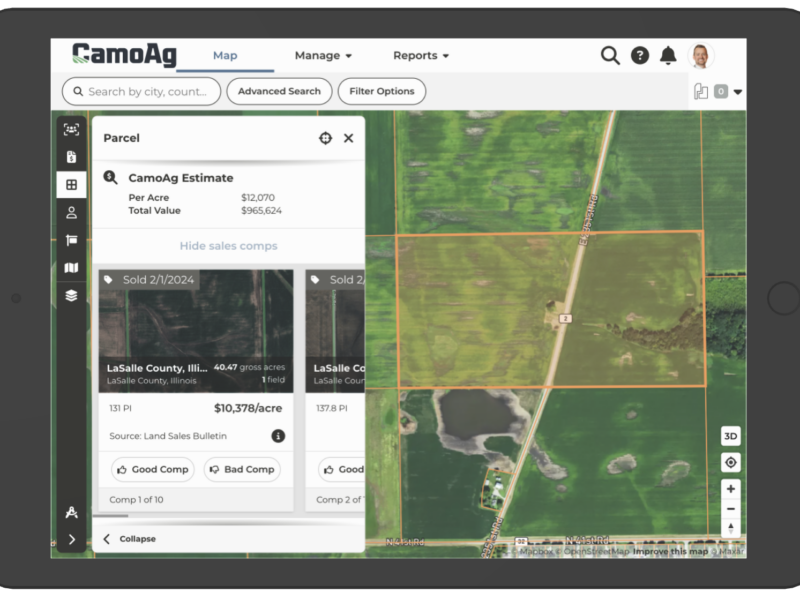

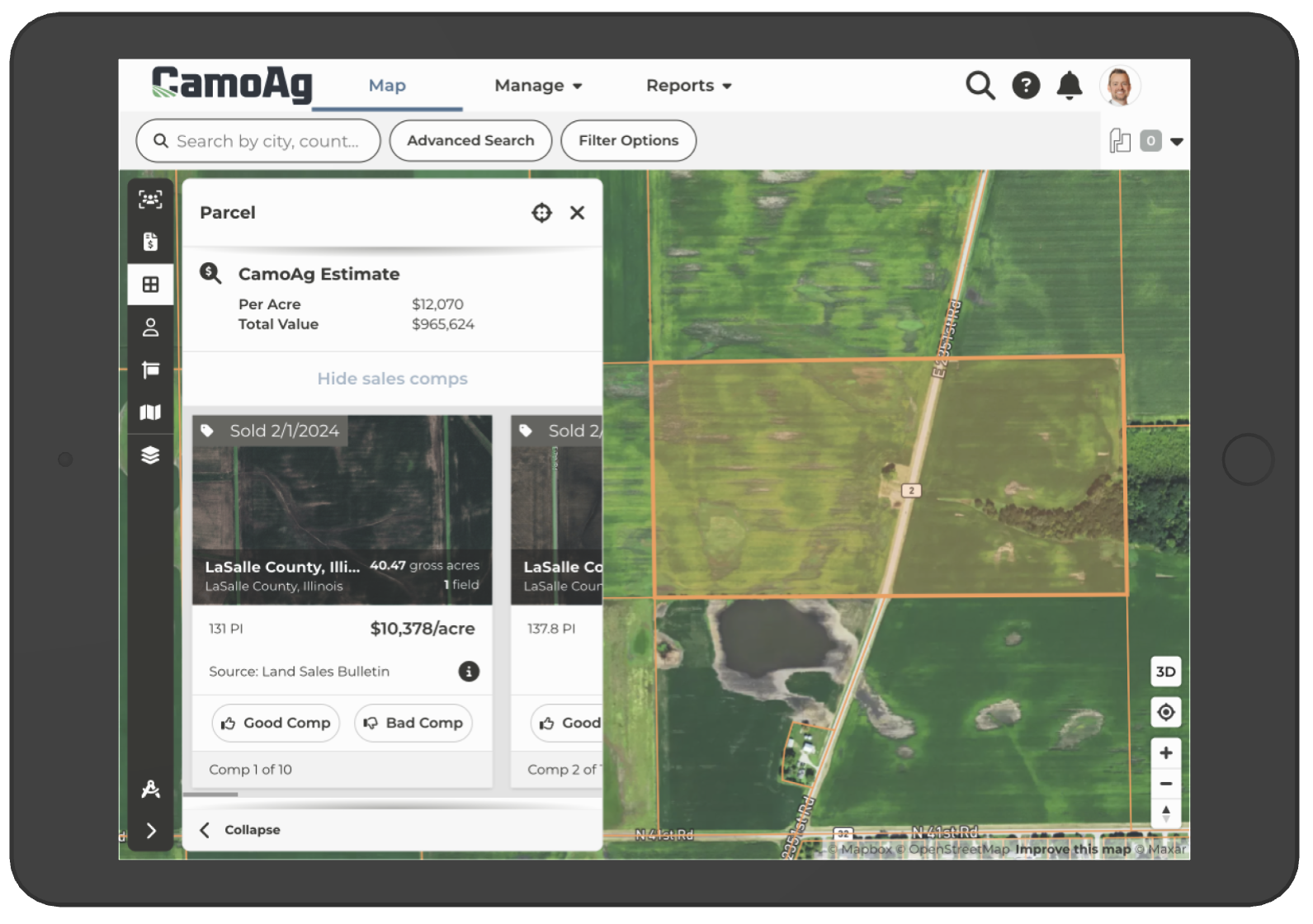

For example, a lender evaluating a 50-acre parcel of unimproved land in Illinois could rely on CamoAg’s AVM to generate a valuation instantly, shaving weeks off the traditional process. These efficiencies are critical in agriculture, where manual data collection and appraisal processes often result in delays.

4. Bridging Data Gaps for a Nationwide Impact

In farmland valuation, the availability and quality of sales data vary dramatically by region. Some areas have abundant, accurate public data requiring minimal effort to validate sales. Other regions rely on personal connections and extensive manual work to collect, analyze, and verify sales.

CamoAg’s AVM addresses this challenge by leveraging a customer’s existing proprietary datasets, enabling effective valuation in regions where traditional AVM approaches have struggled. This capability expands the use of AVMs to previously inaccessible areas, making it a valuable tool for lenders operating nationwide. By bridging these gaps, CamoAg’s AVM ensures that lenders can confidently extend their reach into diverse geographies, from the heart of the Corn Belt to areas with limited public data.

5. Empowering Loan Officers with Data-Driven Insights

CamoAg’s AVM is a valuable resource for loan officers and relationship managers, enabling them to provide customers with unique and proprietary insights without involving appraisers inappropriately. This not only preserves the appraiser’s independence but also ensures that loan officers maintain an arm’s length from offering a value on a property before purchase.

Key advantages include:

- Uninfluenced, Objective Valuations: The AVM generates an independent, third-party-derived value for properties, protecting the loan officer from being associated with the valuation figure.

- Efficient Resource Allocation: By providing routine valuations through the AVM, appraisers can focus on more complex cases while loan officers address customer inquiries quickly.

- Enhanced Customer Trust: Offering accurate and objective data builds credibility with customers, fostering stronger relationships.

For example, a loan officer working with a farmer exploring a 50-acre purchase can leverage the AVM to present a reliable valuation instantly, streamlining discussions and decision-making.

6. Complementing, Not Replacing, Appraisal Expertise

While AVMs are a powerful tool, they are not a replacement for appraisers. Instead, they complement appraisal expertise by handling routine valuations and enabling appraisers to focus on complex cases.

When combined with a credit decision, an AVM can help lenders streamline approvals for properties that meet specific criteria, such as:

- Moderate property value ranges.

- Simple land makeups.

- Strong borrower credit profiles.

For example, an appraiser might rely on CamoAg’s AVM for straightforward cases, enabling them to devote more time to evaluating unique or high-value properties. This targeted approach can significantly reduce cycle times, enhancing customer satisfaction and enabling lenders to close more loans in less time.

Conclusion

CamoAg’s AVM is more than a technological advancement—it’s a transformative tool for the agricultural lending industry. By making AVMs accessible, leveraging proprietary data, and learning from the successes of the home mortgage industry, we’re empowering lenders to achieve greater efficiency, expand their reach, and deliver better outcomes for their clients. The future of farmland valuation is here. Let’s shape it together.